Annual Report Highlights:

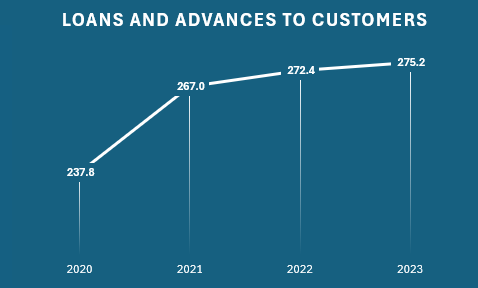

In the past years, our commitment to supporting all key sectors of the economy has driven robust performance across our banking operations. We have strategically focused on enhancing asset quality, which has contributed significantly to the sound performance of our core banking functions.

Key performance indicators (KPIs) for the year are well within acceptable levels, reflecting our strong operational health:

- Capital Adequacy Ratio (CAR): We maintain a solid and secure capital position, ensuring we are well-positioned to meet future growth demands and regulatory requirements.

- Liquidity Position: Our liquidity remains strong, safeguarding against unforeseen challenges and ensuring we can meet our financial obligations efficiently.

- Non-Performing Loans (NPL): With proactive risk management strategies, our NPL ratio stands at a favorable level, reinforcing the quality of our lending portfolio. NPL ratio stands well below the industry averages.

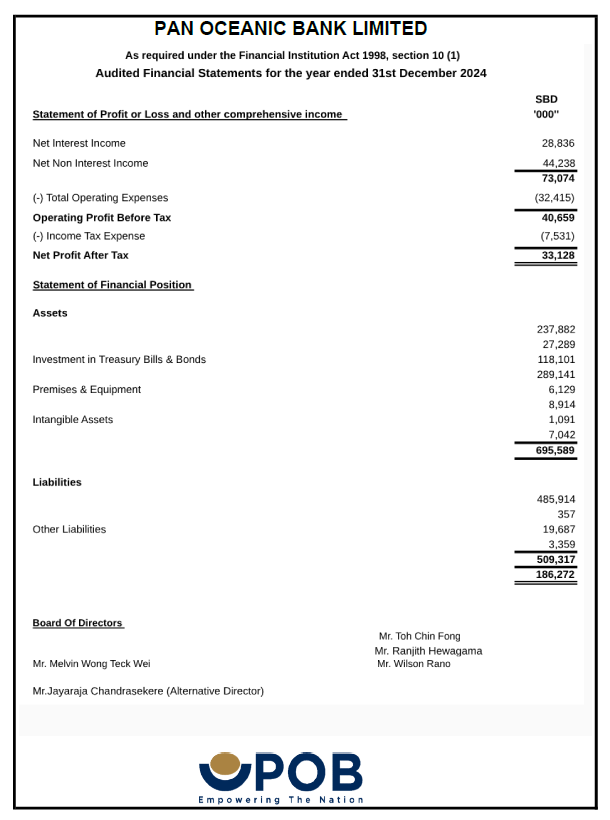

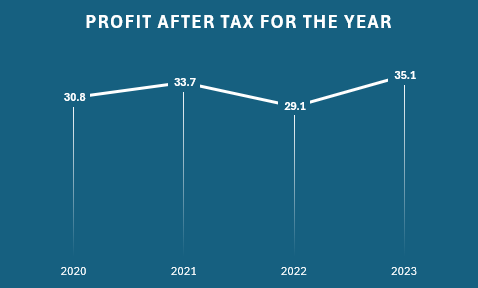

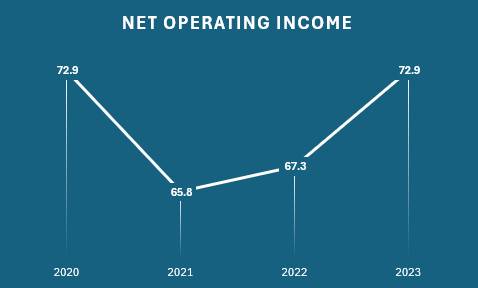

- Profitability: We have achieved sustainable growth in profitability, driven by strategic investments and efficient cost management.

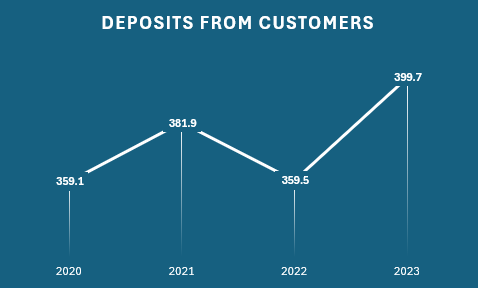

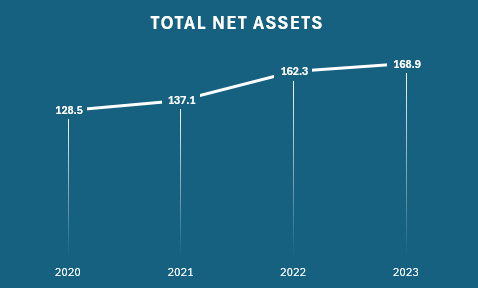

- Asset & Liability Growth: Our balanced approach continues to yield healthy growth across both assets and liabilities, strengthening the foundation for continued success.

Our External Auditor : Ernst & Young (EY)